Description

Book Description

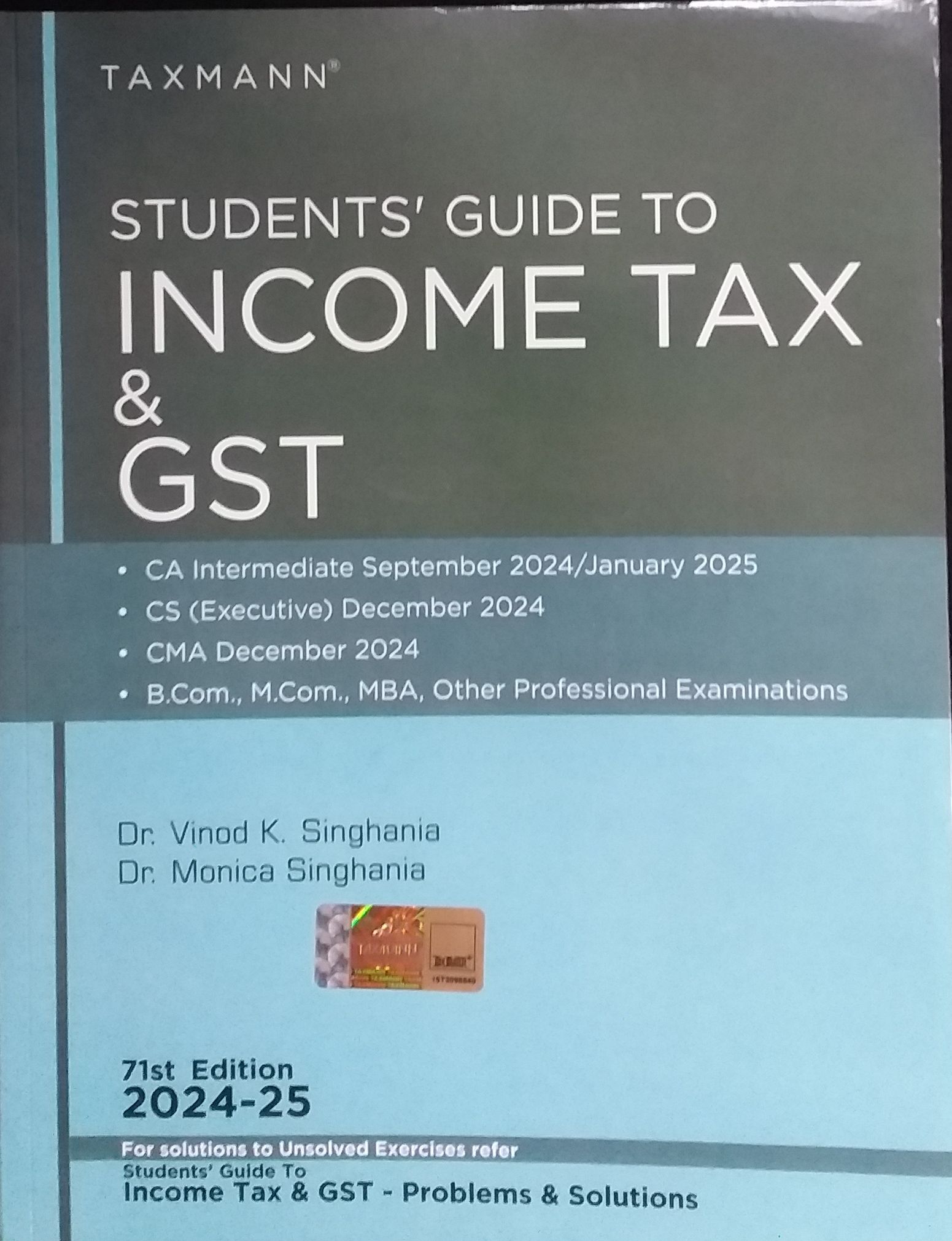

Taxmann’s flagship publication for students on Income Tax & GST Law(s) is designed to bridge the gap between theory and application. Written in simple language, it explains legal provisions step-by-step with suitable illustrations, avoiding paraphrasing and legal jargon.

This book is an authentic, up-to-date, and amended textbook on Income Tax & GST for students of CA Intermediate (Sept. 2024/Jan. 2025), CS Executive (Dec. 2024), CMA (Dec. 2024), B.Com., M.Com., MBA and other professional examinations.

The Present Publication is the 71st Edition | 2024-25 and amended upto 15th June 2024. This book is authored by Dr Vinod K. Singhania & Dr Monica Singhania, with the following noteworthy features:

- [Comprehensive Coverage] of this book includes:

- Unit 1 – Income Taxes

- Unit 2 – GST

- [Extensive Problem Sets] Over 500 solved problems with an equal number of unsolved exercises

- [Past Exam Questions] Includes questions set for CA (Inter/IPCC) examinations over the last five years, with solutions for both theory and practical questions

- Income Tax problems are solved as per the law applicable for A.Y. 2024-25

- GST problems are solved according to the law as amended up to June 15, 2024

- [Features] of this book are as follows:

- [Student-Friendly Approach] The book adopts a ‘teach yourself’ technique, enhancing the learning process with a clear, step-by-step explanation of legal provisions

- [Illustrative Problems] Each chapter includes analytical discussions supported by original problems, fostering a deeper understanding of complex provisions

- [Practical Exercises] To build confidence in solving practical questions, solved problems are followed by unsolved exercises with answers provided in the appendix

- For Solutions to the unsolved exercises, students may refer to the 29th Edition of Taxmann’s Students’ Guide to Income Tax including GST Problems & Solutions

- [Professional Exam Focus] Sections marked with a ➠ symbol cater specifically to professional exam aspirants while also being beneficial for high-achieving university students

- Follows the Six-Sigma Approach to achieve the benchmark of ‘Zero-Error’

The contents of the book are as follows:

- Income Tax

- Basic concepts that one must know

- Residential status and its effect on tax incidence

- Income that is exempt from tax

- Income under the head ‘Salaries’ and its computation

- Income under the head’ Income from house property’ and its computation

- Income under the head’ Profits and gains of business or profession’ and its computation

- Income under the head’ Capital gains’ and its computation

- Income under the head’ Income from other sources’ and its computation

- Clubbing of income

- Set-off and carry forward of losses

- Permissible deductions from gross total income

- Meaning of agriculture income and its tax treatment

- Individuals – Computation of taxable income

- Hindu undivided families – Computation of taxable income

- Firms and association of persons – Computation of taxable income

- Return of income

- Advance payment of tax

- Deduction and collection of tax at source

- Interest payable by assessee/Government

- GST

- Basic concepts of GST

- Concept of Supply

- Levy of GST

- Exemptions from GST

- Place of supply

- Time of supply

- Value of taxable supply

- Reverse charge mechanism

- Input tax credit

- Composition Scheme and Alternative Composition Scheme

- Registration

- Tax invoice, credit and debit notes

- Returns, tax payment and interest

- Provisions governing Real Estate Services

- Problems on GST

- Appendix

- Tax Rates

- Question set for CA (Intermediate) Examinations and Answers

- Depreciation rates for power-generating units

- Answers to unsolved exercises

Author: VINOD K.SINGHANIA

Publisher: Taxmann Publications

ISBN-13: 9789357784931

Language: ENGLISH

Binding: PAPERBACK

Product Edition: 2024

Country of Origin: India

International Shipping: No

Reviews

There are no reviews yet.