Description

Description

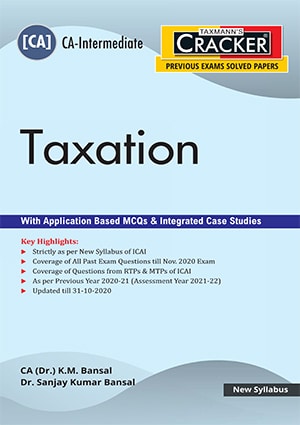

This book is specially designed for students of CA-Intermediate, on the subject of Taxation’. The unique feature of this book is incorporation of past examination question of CA-Intermediate examination, along with application based MCQs & integrated case studies

The Present Publication is the Latest Edition (updated till 31st October, 2020), authored by CA (Dr.) K.M. Bansal & Dr. Sanjay Kumar Bansal for New Syllabus, with the following noteworthy features:

- Coverage of the book is as follows:

o All Past Exam Questions till November 2020

o The trend analysis (for both New/Old Syllabus) (May 2018 onwards) has been given, so that the students may be able to assess the relative importance of a particular topic and can plan his/her schedule accordingly

o Questions from RTPs and MTPs of ICAI

o Chapter-wise marks distribution for past examinations has also been given

o Chapter-wise comparison with Study Material of ICAI

- Also Available:

o [64th Edition] of Taxmann’s Students’ Guide to Income Tax including GST

o [22nd Edition] of Taxmann’s Students’ Guide to Income Tax including GST – Problems & Solutions

- Contents of the book are as follows:

Section A (Income Tax Law)

o Basic Concept

o Residence and scope of total income

o Incomes which do not form part of total income

o Income from Salaries

o Income from House Property

o Profits and gains from business or profession

o Capital Gains

o Income from other sources

o Clubbing of Income

o Set off and carry forward of losses

o Deductions from gross total income

o Agriculture income

o Computation of total income and tax payable

o Advance tax, TDS and TCS

o Provisions for filing of return of income and self-assessment

Section B (Indirect Taxes)

o GST in India

o Supply under GST

o Charge of GST

o Exemptions from GST

o Time of supply

o Value of supply

o Input tax credit

o Registration

o Tax invoice, credit and debit notes

o Payment of tax

o Returns

Section C (MCQs & Integrated Case Studies | Income Tax)

o Multiple Choice Questions (MCQs)

o Case Studies

Section D (MCQs & Integrated Case Studies | GST)

o Multiple Choice Questions (MCQs)

o Case Studies

Author: K.M.Bansal

Publisher: K.M.Bansal

ISBN-13: 9.78939E+12

Language: English

Binding: Paper Back

Country of Origin: India

Reviews

There are no reviews yet.