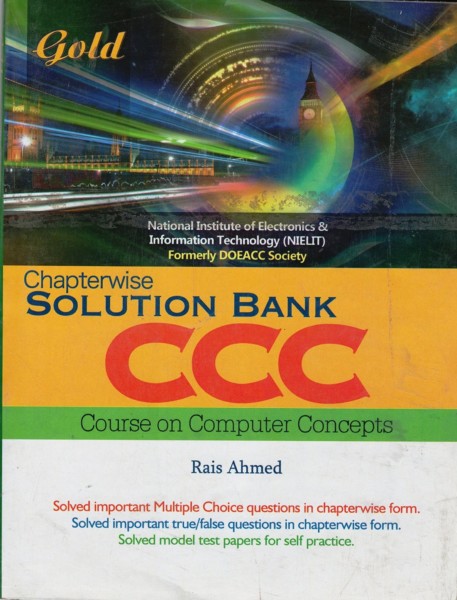

Description

(Now with how to file GSTR 1/2/3B, Purchase from unregistered dealers, Interest calculations, TCS,?File quarterly e-TDS/TCS, EEZ,??E-way Bill,?Practical Exercises?and much more)

It provides step-by-step instructions for ??Installation???Creating a Company???Features & Configuration???Ledgers & Groups ??Inventory???Voucher?Entry???Stock Journal?? Credit/Debit Notes ??Purchase and Sales Registers???Accounting Reports???P/L Statements???Trial Balance???Cheque Printing?? Statement of A/c ??Deposit Slips???Bank Reconciliation???Salary Processing???Generating?Financial Reports???Cost Centre???Order Processing???Data Backup & Restore???Payroll???TDS???E-Filing???Emailing???Concepts &?Implementation of GST,?GST Reports, Input Tax Credit, GSTR-1/2/3B Return, Depreciation, E-Way Bill,??File quarterly e-TDS/TCS, EEZ, sales from other territories to UT,?COMPOSITION SCHEME,?Practical Exercises?and all?NEW? FEATURES OF 6.1/ 6.2/6.3/6.4???and Much More.

Author: BPB

Publisher: BPB

ISBN-13: 9.78939E+12

Language: ENGLISH

Binding: PAPERBACK

No. Of Pages: 314

Country of Origin: India

International Shipping: Yes

Reviews

There are no reviews yet.